Union Finance Minister Nirmala Sitharaman’s mid-term Union Budget 2024-25 failed to impress many and dodged the middle-class taxpayers’ long-term expectation of further exemptions. While Ms Sitharaman emphasised resolving India’s unemployment crisis, the elephant in the room wasn’t addressed how it should’ve been.

Understanding the state of the economy

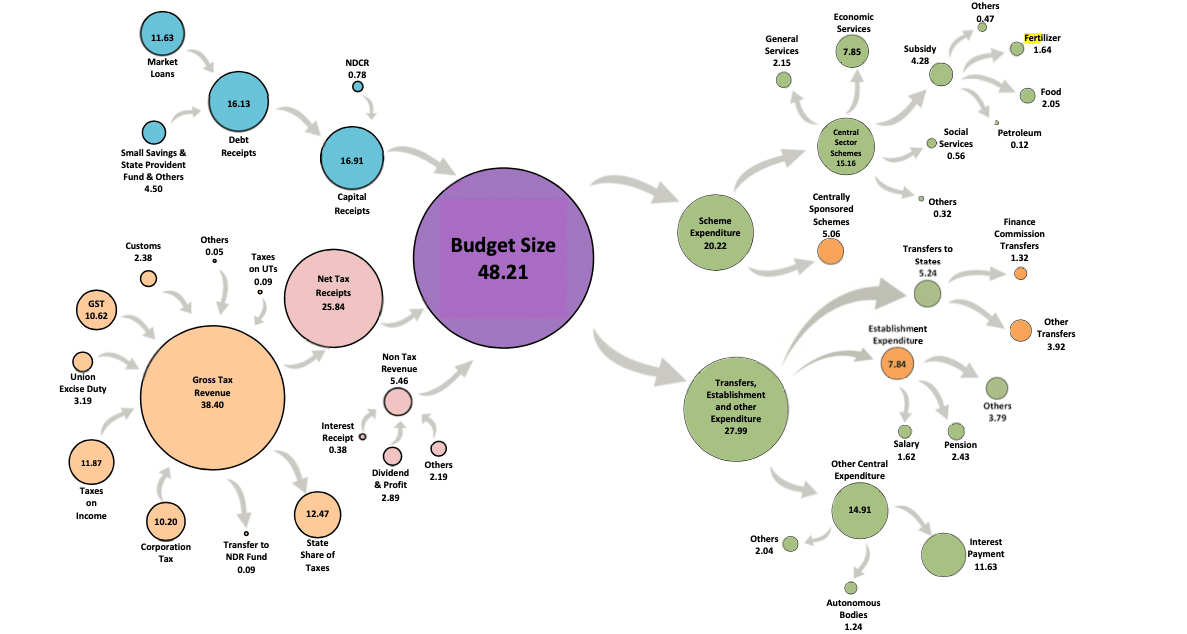

Broadly, the total budget estimates (BE) for the financial year (FY) 2024-25 is estimated at Rs 48.2 trillion against total expenditure in the provisional actual for FY2023-24, Rs 44.42 trillion, of which total capital expenditure is Rs 11.11 trillion; reflecting a 16% increase.

Tax revenue, at Rs 25.83 trillion, remains the highest contributor to the total revenue receipt of Rs 31.29 trillion. It’s ironically followed by ‘borrowing and other liabilities’ of Rs 16.13 trillion.

External Grants (non-tax revenue) earlier expected around Rs 21.35bn in FY 2023-24, is Rs 10.44bn in FY 2024-25. Dominating expenditures are the States’ share of expenditures and duties (21%) followed by interest payment (19%). Grants in aid for the creation of capital assets in FY 24-25 are expecting an increment of Rs 869.91bn vis-a-vis last year’s provisional actual.

Effective revenue deficit—the difference between revenue deficit and grant-in-aid for the creation of capital assets— is expected to be around Rs1.89 trillion, against the provisional actuals of FY 2023-24 of Rs 4.61 trillion.

The primary deficit—the fiscal deficit, less interest payments—stands at Rs 5.89 trillion in provisional actual FY 2023-24 and is expected to be around Rs 4.5 trillion. As expected, interest payment expenditure hasn’t changed much, reflecting an expected decrease in fiscal deficit.

The mid-term Union Budget 2024-25 and the vision of ‘development’

Prime Minister Narendra Modi claimed in different political rallies of his ruling Bharatiya Janata Party (BJP) that for him there are four castes— the ‘Annadata’ (food provider or the farmer), ‘Garib’ (the poor), ‘Mahilayen’ (women) and ‘Yuva’ (the youth).

Ms Sitharaman also singled out each group in the mid-term Union Budget 2024-25. However, a lacuna remains between what’s claimed and what has been delivered.

For the ‘Annadata’, the Pradhan Mantri Kisan Samman Nidhi (PM-Kisan) or the farmers’ pension fund remains the same at Rs 600bn. This means the project will not accommodate new farmers in the rural areas amid the growing farm crisis.

Ms Sitharaman has significantly reduced the subsidy on fertilisers, the key input factor in India’s agriculture. While the BE of fertiliser subsidy was pegged at Rs 1.75 trillion for FY 2023-24, the revised estimate (RE) showed a significant increase in expenses and, finally, Rs 1.89 trillion was allocated. However, in her mid-term Union Budget 2024-25, Ms Sitharaman allocated only Rs 1.64 trillion for fertiliser subsidy.

While Rs 136.25bn was allocated in FY 2023-24 as BE for crop insurance, in the mid-term Union Budget 2024-25, the RE was Rs 150bn. Still, Ms Sitharaman allocated Rs 146bn as the BE for crop insurance for FY 2024-25.

Consider the Rashtriya Krishi Vikas Yojna (National Agriculture Development Scheme), under which only 8,971 projects out of a total of 19,046 approved projects have been completed until July 23rd, when Ms Sitharaman presented the budget. In the FY 2022-23, Rs 52.47bn was spent on the programme. The government allocated Rs 71.5bn for FY 2022-23, but the RE was only Rs 61.5bn. Now Ms Sitharaman has increased the BE to Rs 75.53bn but it’s not clear whether this amount will be spent or not.

Similarly, Krishionnati Yojana (Agriculture Development Scheme), which had a BE of Rs 70.66bn but an RE of Rs 63.78bn, got an allocation of Rs 74.47bn.

A row on the legal guarantee of minimum support prices (MSP) for crops according to the MS Swaminathan Commission Report sparked off when the Opposition Indian National Developmental Inclusive Alliance (INDIA) bloc raised the issue, which the government has been trying to place in the oblivion.

The INDIA bloc declared that it will pressurise Mr Modi’s government and explore all possibilities to ensure farmers a legal guarantee for MSP, after meeting 12 member delegation of farm union leaders from Punjab, Haryana, UP, Telangana, Tamil Nadu and Karnataka.

They demanded the implementation of the MSP regime, which the government promised to mull as a condition in return for the farmers withdrawing their 2020-21 agitation from Delhi’s borders.

While the Opposition insisted on MSP according to the Swaminathan Commission’s recommendations, Ms Sitharaman shot back at them, reminding them that the report was released during the Indian National Congress (INC)-led United Progressive Alliance (UPA) era but they chose to do nothing.

Regarding the poor, there’s nothing specific in the mid-term Union Budget 2024-25.

While the government has pushed the onus of job creation to the market, it has ensured that one of the last vestiges of a welfare state, the Mahatma Gandhi National Rural Employment Guarantee Act (MNREGA), continues to face stagnation.

While the actual expenses for MNREGA in FY 2022-23 were Rs 908.06bn, Ms Sitharaman allocated only Rs 600bn in FY 2023-24. Still, due to growing rural unemployment, the RE reached Rs 860bn. Now, Ms Sitharaman didn’t increase the BE for MNREGA to meet the actuals of FY 2022-23, rather, adjusting to spiralling inflation, she has kept the BE at Rs 860bn.

This is happening when several States, including West Bengal, have been alleging that the Union has been sitting on their payouts for MNREGA workers and not transferring the funds. Can the government afford a status quo in MNREGA when it’s one of the last resorts for rural agricultural labourers?

The prime minister’s flagship food ration programme—Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY)—which has been extended year-upon-year, exemplifying the lack of overall purchasing power of the poor, has also faced a cut in the mid-term Union Budget 2024-25.

While the actual expenses were Rs 2.73 trillion in FY 2022-23 for PMGKAY, in FY 2023-24 Ms Sitharaman allocated Rs 1.97 trillion for the programme and the government ended up paying Rs 2.12 trillion as RE.

Despite this drastic cut in the food ration programme within a year, Ms Sitharaman has sealed the deal at a lower bar this time. She has allocated Rs 2.05 trillion for the programme. It shows that the government is gradually going to reduce expenses on food grains for the poor while continuing the scheme for political reasons beyond its stipulated time.

The Pradhan Mantri Awas Yojana (PMAY) or the PM’s housing scheme is a flagship, rebranded programme of the Union government through which financial assistance is provided to the poor in rural and urban India for house construction.

There are allegations, especially from the Government of West Bengal, that the Union didn’t pay the due amounts of the PMAY scheme for the state over petty political rivalry.

While the actual expenses for PMAY rural was Rs 449.62bn in FY 2022-23, Ms Sitharaman had allocated Rs 544.87bn in FY 2023-24, out of which only Rs 320bn was spent. In FY 2024-25, she again allocated nearly the same sum for PMAY rural without clarifying whether the government would clear the arrears of the States.

In PMAY urban, while the actual expenses for FY 2022-23 were Rs 286.53bn, she allocated Rs 251.03bn in FY 2023-24 and could spend Rs 221.03bn. In the mid-term Union Budget 2024-25, she has allocated Rs 301.71bn, but it’s to be seen how much of this amount would be actually spent.

For the women, Ms Sitharaman didn’t have much promising optics either.

Consider the case of Saksham Anganwadi and POSHAN 2.0 (umbrella ICDS—nursery services, nutrition drive and scheme for adolescent girls), matching the RE of FY 2023-24—Rs 215.23bn—Ms Sitharaman has allocated Rs 212bn for FY 2024-25.

Also, in the case of Mission Shakti (Mission for Protection and Empowerment for Women), the Union had spent Rs 23.4bn in FY 2022-23 and allocated Rs 31.44bn for FY 2023-24. However, even in the last FY, the government could spend Rs 23.26bn. In the mid-term Union Budget 2024-25, Ms Sitharaman has allocated Rs 31.46bn for Mission Shakti, a meagre Rs 20m increase.

The entire budget for the Ministry of Women and Child Development has increased by about Rs 6bn, which isn’t impressive considering the size of India’s women population.

For the youth, the mid-term Union Budget 2024-25 introduced the Modi government’s flagship apprenticeship programme, which aims to provide the first timers with a month’s salary of Rs 15,000, through direct benefit transfer but this is conditional.

Over a million posts are lying vacant with the Union government, especially in the Indian Railways. However, Ms Sitharaman didn’t mention anything related to the government’s efforts to fill those positions.

The government has retained the controversial Agniveer scheme, which came under scathing attack from the Opposition as it reduces the scope of secure employment in the armed forces and Central paramilitary forces.

Rather than playing the role of an employer to generate more demand in the economy, the government has pushed the onus to the private sector’s court even though there has been a large-scale contraction in private sector jobs over the last few years.

The government has promised to provide internship opportunities in the top 500 companies to 10m youth with an allowance of Rs 5,000 per month and one-time assistance of Rs 6,000.

The INC called this scheme a “copy-paste exercise”. Former finance minister P Chidambaram posted on X, “I am happy she has virtually adopted the Employment-linked incentive (ELI) outlined on page 30 of the Congress Manifesto… I wish the FM had copied some other ideas in the Congress Manifesto.”

However, the INC in its manifesto had guaranteed a minimum of Rs 100,000 to the youth through an apprenticeship scheme. The Modi government has reduced the scope to the utmost of Rs 60,000 a year.

Speculations before the mid-term Union Budget 2024-25 predicted a revision of the Income Tax slabs to provide the salaried classes relief amid growing inflation. However, except for a minor slab readjustment in the New Tax Regime, under which taxpayers don’t enjoy exemptions unlike the Old Tax Regime, there have been no changes in the Income Tax scenario.

Ms Sitharaman has claimed that taxpayers can save up to Rs 17,500 through this route. The attempt is seen as a move to push more taxpayers into the New Tax Regime.

Surprisingly, Ms Sitharaman has reduced the tax slab for foreign corporates willing to invest in India. This comes at a time when the income-expenditure statement of the government shows that it has earned more money from the taxpayers rather than the corporate sector.

In FY 2023-24, while the Union government earned Rs 10.2 trillion from corporate taxes, it earned Rs 11.87 trillion from income taxes. The total earnings from the Central Goods and Services Tax (CGST) was Rs 9.10 trillion.

Observers have already started speculating that removing indexation from the Long-term Capital Gain Tax (LTCG) on properties may spell doom for the real estate sector, as investors will prefer cash transactions over legitimate deals.

Those with ancestral property will have to shell out much more in taxes than before, while long-term investments (over ten years) on property will practically cease. Swing traders in the share market, a majority of whom earn less than Rs 50,000 in a month, will now have to pay much more in taxes than earlier.

On this, Bahujan Samaj Party president Mayawati claimed that the mid-term Union Budget 2024-25 lacks the required reformist measures for the uplift of the underprivileged sections.

“Today’s Budget follows the same old pattern, where except for a handful of wealthy people, it offers little hope of good days for nation’s poor, farmers, unemployed, women, labourers, marginalised and neglected communities and is full of disappointment for them,” Ms Mayawati said in a post on X.

Despite tall promises, the mid-term Union Budget 2024-25 couldn’t do proper balancing between needs and aspirations. Some of the crucial lacunae in the budget are the lack of focus on filling government vacancies, reforming Income Tax slabs for the salaried classes, increasing allocations for education, healthcare and crucial Union schemes like the MNREGA.

Apart from this, there is a need to allocate more funds for farmers, women, scheduled castes and tribe development, and other sectors. While doing so, the government has to show fiscal prudence and it’s not clear whether the fiscal deficit can be reduced to 4.9% as stated by Ms Sitharaman during her speech.

Join our channels on Telegram and WhatsApp to receive geopolitical updates, videos and more.