The head of Credit Suisse Group AG and its biggest shareholder, Ammar Al Khudairy, has quit just days after his remarks contributed to a decline in the stock of the Swiss lender.

Citing “personal reasons”, Al Khudairy is stepping down as chairman of Saudi National Bank, which he joined in 2021 after National Commercial Bank and Samba Financial Group merged. Saeed Mohammed Al Ghamdi, the bank’s chief executive officer, will replace him.

A few weeks ago, Al Khudairy had clarified in an interview with Bloomberg TV that the Saudi National Bank would refrain from additional investments in Credit Suisse if the latter requested more liquidity. He denied the scope of any liquidity calls, which opened a floodgate of crisis for the Swiss bank.

Following his remarks, the credit spreads of the Swiss bank increased, and its shares hit a new low. After the failure of three American banks, investors stayed away from risk, which contributed to a decline in all European banks.

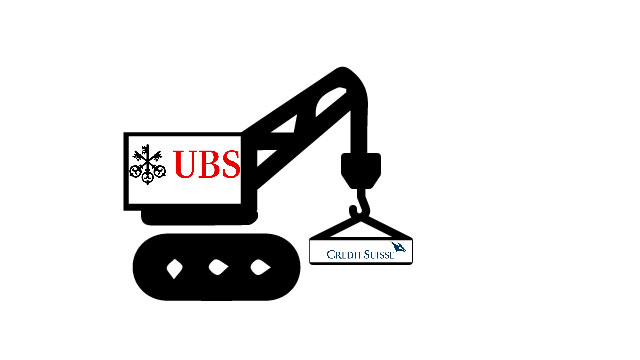

Days later, in a historic transaction facilitated by the Swiss government, Credit Suisse’s competitor UBS Group AG decided to acquire the crisis-hit bank to stem the confidence crisis that had begun to spread throughout the world’s financial markets. UBS made an all-share bid to buy its competitor for 3bn Swiss francs ($3.3bn) containing hefty government guarantees and liquidity clauses.

After purchasing an approximately 9.9% stake in Credit Suisse for 1.4bn francs last year, Saudi National Bank’s stock value fell by about $1bn in just a few months. The kingdom’s sovereign wealth fund owns around 37% of stakes in the bank.

The 60-year-old Al Khudairy has spent his entire career in Saudi Arabia’s finance industry, overseeing some of the best organisations in the country. Al Khudairy had also headed western financial giants like Goldman Sachs and Morgan Stanley in the region.

Al Khudairy also established Riyadh-based Amwal AlKhaleej and Dubai-based Amwal Capital Partners.

Additionally, the Saudi National Bank named Talal Ahmed Al Khereiji as interim CEO. Prior to this, he served as the Saudi lender’s vice CEO and chief of wholesale finance.