The Indian stock markets bled severely on Monday, February 27th. Nifty50 and Sensex equity benchmarks suffered extending losses on the seventh consecutive trading day. Experts view this loss as a result of uncertainties rising over fear of further rising benchmark interest rates.

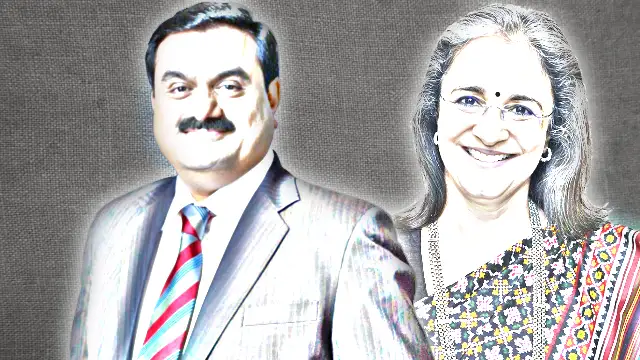

India’s controversial power-to-ports conglomerate Adani Enterprises Ltd (AEL) continued on its losing spree, even after a month of Hindenburg Research report on alleged stock market manipulation practiced by the group.

The AEL stocks ended up at 10% lower on Monday, as Indian stock markets continued expressing inhibition regarding the conglomerate’s financial health. AEL, Adani Green Energy, Adani Total Gas, and Adani Transmissions were the worst performers among the seven of Adani’s listed companies.

Nifty Midcap 100 and Nifty Smallcap 100 closed 0.7% and 11% lower, respectively. A total of 956 stocks rose, and 2,593 stocks fell on Monday, exhibiting a bear rage in the market.

The Nifty50, the largest index of Indian stock markets, sank to 17,392.7, which is 73.1 points or 0.4% loss vis-à-vis its last closing. The Nifty50 moved between 17,300 to 17,450 band throughout the day.

The Bombay Stock Exchange’s Sensex suffered a 175.6 points loss and ended at 59,288.4 at the end of the day.

Among the top 17 gainers, HDFC Life, ICICI Bank, Kotak Mahindra Bank, PowerGrid, and State Bank of India (SBI) are the prominent ones. The SBI had earlier suffered due to its alleged exposure to AEL’s stocks.

Apart from Adani, the shares of Bajaj Auto, Infosys, Tata Steel, and UPL were some of the major sufferers in the Indian stock markets on Monday. The Indian stock market investors are keenly awaiting the country’s GDP data for the third quarter (Q3) of the financial year 2022-23, which will be released on the evening of February 28th.

The Indian stock markets may further suffer on Wednesday, March 1st, if the Q3 GDP results aren’t promising.